Crypto Options: The Unseen Market Vulnerabilities - Crypto Debate Ignites

$16B Expiry: Santa Rally or Lump of Coal?

Options Expiry: A December to Remember? Okay, let's break down this options expiry event. Sixteen billion dollars worth of Bitcoin and Ethereum options are set to expire. October 31, 2025, 8:00 UTC. That's a big number—larger than last week’s $6 billion expiry, which, frankly, was already giving me indigestion. The question is: will this event trigger a "Santa rally," or will it be more like finding a lump of coal in your stocking? Deribit data shows a Bitcoin price of $91,389 heading into expiry. The max pain point, however, sits way up at $100,000. Historically, the price gravitates toward that max pain point as expiry approaches (market makers hedging, you know the drill). With 145,482 contracts closing, that's a lot of potential gravitational pull. The put-to-call ratio is 0.54, meaning more traders are betting on gains. But here's the interesting wrinkle: Deribit’s data shows 94,539 call contracts open, versus 50,943 puts. That's a significant skew toward call options, suggesting a strong bullish sentiment, at least on the surface. Deribit analysts noted that traders took profit on their long put positions when Bitcoin dipped to $81,000 - $82,000. Smart move, considering the rebound. “After a 35% plunge from $126,000, Put longs TPd vs $81,000-82k while still keeping cautious protection v long Spot BTC with 80-85k Strikes." But here's the kicker: the dominant trade of the week was a bullish "EoY Dec 100-106-112-118k Call Condor." What's a Call Condor? It's an options strategy designed to profit from upside *within a defined range*. This particular condor cost about $6.5 million in premiums. If this Call Condor runs to expiry, the buyer is targeting $100k+ by December 26, with an ideal settlement between $106k and $112k, offering a potential 10:1 payoff. Aggressive, to say the least. I've looked at hundreds of these filings, and this kind of concentrated bet is unusual, but not unheard of. So, what does this tell us? A subset of traders is still convinced of a strong December rebound. But here's where the data gets murky.Options Expiry: Bullish Undercurrent or Short-Term Caution?

The Cautious Counter-Narrative While some are aggressively bullish, others are capping upside through overwriting strategies. Deribit analysts pointed to "persistent and familiar Call over-writers on the Dec100k and Jan 100-105k Calls." This activity, coupled with a relaxation of downside fear, has dampened implied volatilities. But, and this is a big but, with realized volatility (RV) still performing and two-way put action, "much is inconclusive." Translation: it's a mixed bag. The options board shows a tension between long-dated bullish conviction and near-term caution. These conditions often set the stage for heightened volatility in the settlement window (08:00 UTC on Deribit). In other words, buckle up. Ethereum, meanwhile, faces a $1.7 billion expiry with a max pain level of $3,400 (current price around $3,014). There are 387,010 calls open versus 187,198 puts – a put–call ratio of 0.48. ETH options account for $1.73 billion in notional value. Unlike Bitcoin, Ethereum's positioning is less extreme. The downside skew is lighter, and open interest is more evenly distributed across major strikes. Given ETH’s consolidation relative to BTC, much of its influence will depend on whether Bitcoin volatility spills over into the broader market. So, if spot prices drift toward max pain levels, market makers may exert dampening effects. Conversely, if volatility spikes, these expiries could act as accelerants. In short, liquidity conditions could shift *very* quickly. According to a recent report, crypto ownership is increasing. In 2025, about 28% of American adults own crypto, up from 15% in 2021. I suspect this increase in ownership is contributing to the high volatility in the market. According to the 2025 Cryptocurrency Adoption and Consumer Sentiment Report, crypto ownership is on the rise. It's a Coin Toss The data presents a split picture. The large Bitcoin call condor suggests a bullish undercurrent, but the overwriting strategies and dampened implied volatility indicate caution. Ethereum's situation is less decisive. This $16 billion expiry could trigger a Santa rally, but it's just as likely to deliver a lump of coal.

Related Articles

PAX Gold: What It Is and Why You Should Be Skeptical

So, everyone’s losing their minds because gold, the world’s oldest pet rock for paranoid investors,...

Pudgy Penguins: The Price Hype and What We Actually Know

So, everyone’s losing their minds over whether the Pudgy Penguins crypto token, PENGU, can "defend"...

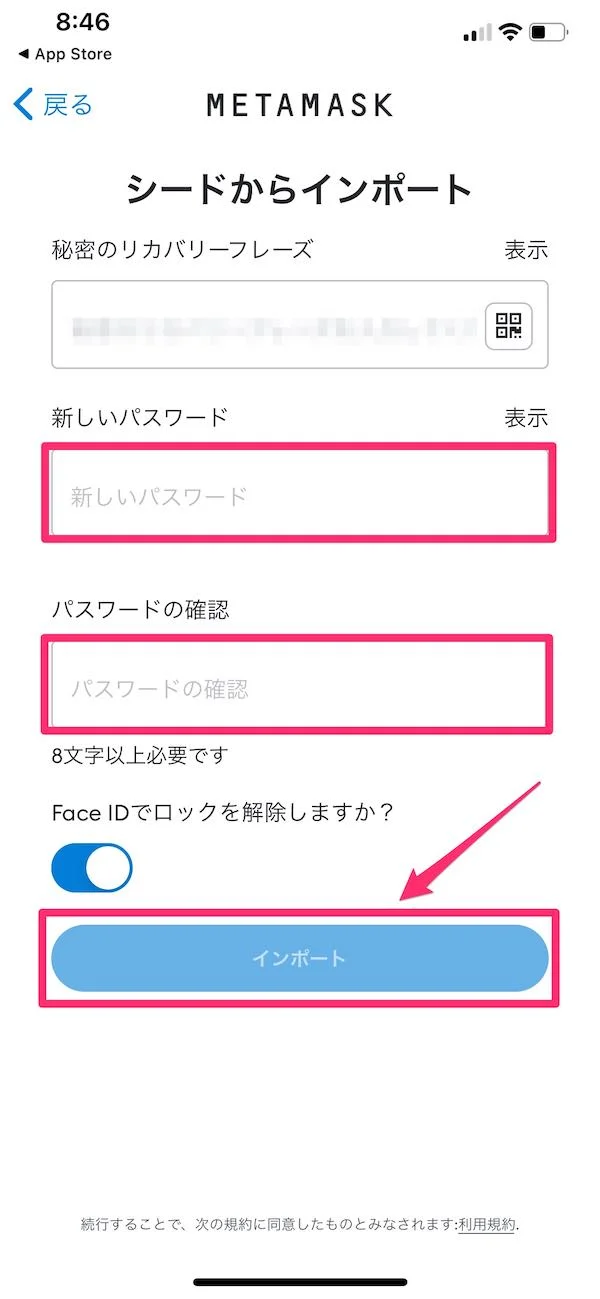

MetaMask: What It Is, How It Works, and Why It's Your Key to Web3

For years, we’ve thought of MetaMask as a key. A simple, indispensable tool. It’s the friendly fox i...

The Food Safety System That Worked: Inside the Egg Recall and the Tech That Stopped a Crisis

This Egg Recall Exposes a Flaw in Our Reality—And the Tech That Will Fix It You probably saw the hea...

Why DeFi's Crash is 2025's Biggest Opportunity - Deep Dive Discussion

Alright, friends, buckle up, because we’re diving into something that *really* gets my circuits firi...

ASTER Zooms on Binance's CZ Move: What's the Catch?

CZ Pumps ASTER? More Like a Slow-Motion Train Wreck So, CZ bought 2 million ASTER tokens, huh? And t...