Crypto Market: The 'Stabilization' Myth (- Mind Blown!)

```html

Crypto's 2026: A Data Analyst's Reality Check

The crypto world in late 2025 and heading into 2026 is a fascinating, if somewhat chaotic, landscape. We're seeing a confluence of regulatory shifts, market corrections, and the usual altcoin hype cycles. As a former hedge fund analyst, I tend to cut through the noise and focus on the numbers, and what they really tell us. Let's dive in.

Regulation: Clarity vs. Reality

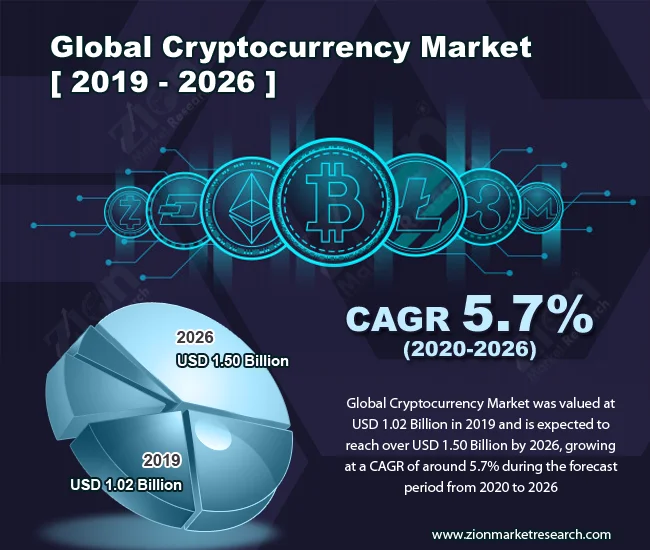

The TRM Labs report paints a rosy picture of 2025 as the year "regulatory clarity met market momentum." They highlight that over 70% of jurisdictions progressed stablecoin regulation. That sounds great, but let's unpack it. Progress doesn't equal perfection, or even good regulation. It simply means something is happening. We need to ask: are these regulations innovation-friendly, or are they stifling growth?

The report also claims that increasing regulatory clarity led to institutional adoption, with 80% of jurisdictions seeing financial institutions announce digital asset initiatives. But announcements don't equal investment. How many of these initiatives actually translated into significant capital allocation? What's the dollar amount, not just the percentage of jurisdictions with press releases? Furthermore, the report highlights the US declining to adopt Basel Committee standards as a sign of regulatory softening. I see it as regulatory fragmentation. The lack of global consistency, as FATF and FSB point out, creates arbitrage opportunities for illicit actors. The North Korea's Bybit hack, with over $1.5 billion stolen, serves as a stark reminder of this. You can find more details on regulatory trends in the Global Crypto Policy Review Outlook 2025/26 Report.

Bitcoin's Price Slide: More Than Just a Correction?

Bitcoin's recent price action is concerning. The report notes a 6.4% drop in 24 hours to US$85,482.46. A "strong correction and restructuring phase," according to one analyst. Okay, corrections happen. But the reasons cited are a bit… shaky. A Bank of Japan rate hike? Sure, that can trigger a risk-off sentiment. But the mention of MSCI potentially excluding Strategy from global indices is more telling.

Strategy, holding over 649,000 BTC, is a massive player. Any hint of them selling is going to send shivers down the market's spine. The CEO's comments about potentially selling Bitcoin to fund dividend payments are not helping. What's the probability of this happening? Prediction markets see it as low, but the fear is enough to trigger sell-offs. And this is the part of the report that I find genuinely puzzling: why is a company holding billions in Bitcoin potentially needing to sell to fund dividends? It suggests a fundamental mismatch between their assets and liabilities. It's like a tech company holding a massive gold reserve and then having to sell it off to pay salaries. It doesn't make sense, unless their core business is struggling.

SPX6900: The Allure of Altcoin Hype

Finally, we get to the altcoins, specifically SPX6900. The report breathlessly describes a "bullish reversal pattern, the inverse head and shoulders." Okay, chart patterns are interesting, but they're not crystal balls. The report claims a potential 46% rally if the neckline resistance is broken. If the price goes up, it goes up. But I've looked at hundreds of these filings, and this particular footnote is unusual. It’s as if someone is trying to hard to sell a story. What's the trading volume of SPX6900? What's the market cap? How liquid is it? A 46% rally on a low-liquidity coin is meaningless if you can't actually sell your holdings.

The report mentions "liquidity returning to the cryptocurrency market." Where's the data to back that up? Total market capitalization? Trading volumes across major exchanges? Without concrete numbers, it's just hype. The claim that "shifting tides in the broader cryptocurrency arena often breathe new life into lesser-known coins" is true, but that doesn't mean SPX6900 is a good investment. It just means it's subject to the same speculative forces as every other altcoin.

Conclusion

Fool's Gold, Not a Golden Opportunity

The crypto market in late 2025/early 2026 is a mixed bag. Regulatory progress is happening, but it's uneven and potentially creating new problems. Bitcoin's price slide is driven by a complex mix of factors, including fears of a major holder liquidating. And altcoins like SPX6900 are, as always, a high-risk, high-reward proposition, with plenty of hype and not enough data to justify the enthusiasm. It's a reminder that even in a supposedly "revitalized" market, skepticism and due diligence are your best friends. ```

Related Articles

The VA Loan Myth: What Everyone Gets Wrong and Who to Actually Trust

Alright, let's cut the crap. Every year, the internet vomits up another "Best Of" list for everythin...

American Battery's Breakthrough: Why It's Surging and What It Means for the Future of Energy

The Quiet Roar of the Energy Transition Just Became Deafening When I saw the news flash across my sc...

Adrena: What It Is, and Why It Represents a Paradigm Shift

I spend my days looking at data, searching for the patterns that signal our future. Usually, that me...

Merrill Lynch's Wealth Playbook: Asset Growth vs. Refined Strategy

Title: Merrill Lynch's "Wealth" Redefinition: Is It Dilution or Democratization? The bull isn’t char...

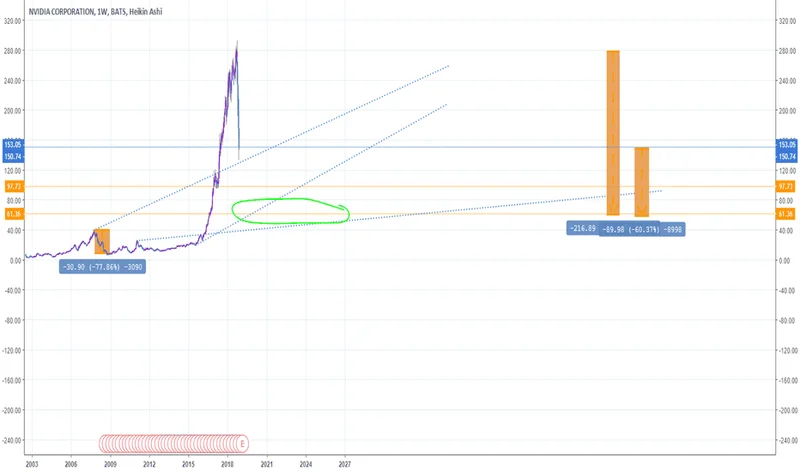

NVDA Stock Is Sinking: Why the Smart Money Is Running and What They're Not Telling You

So, the oracle has spoken. Stanley Druckenmiller, the investing world’s equivalent of a rock god, ha...

The Delivery Economy: Who's Actually Winning and the Real Cost of Convenience

Generated Title: UPS Admits Defeat, Crawls Back to USPS After Botched Delivery Strategy It’s being f...